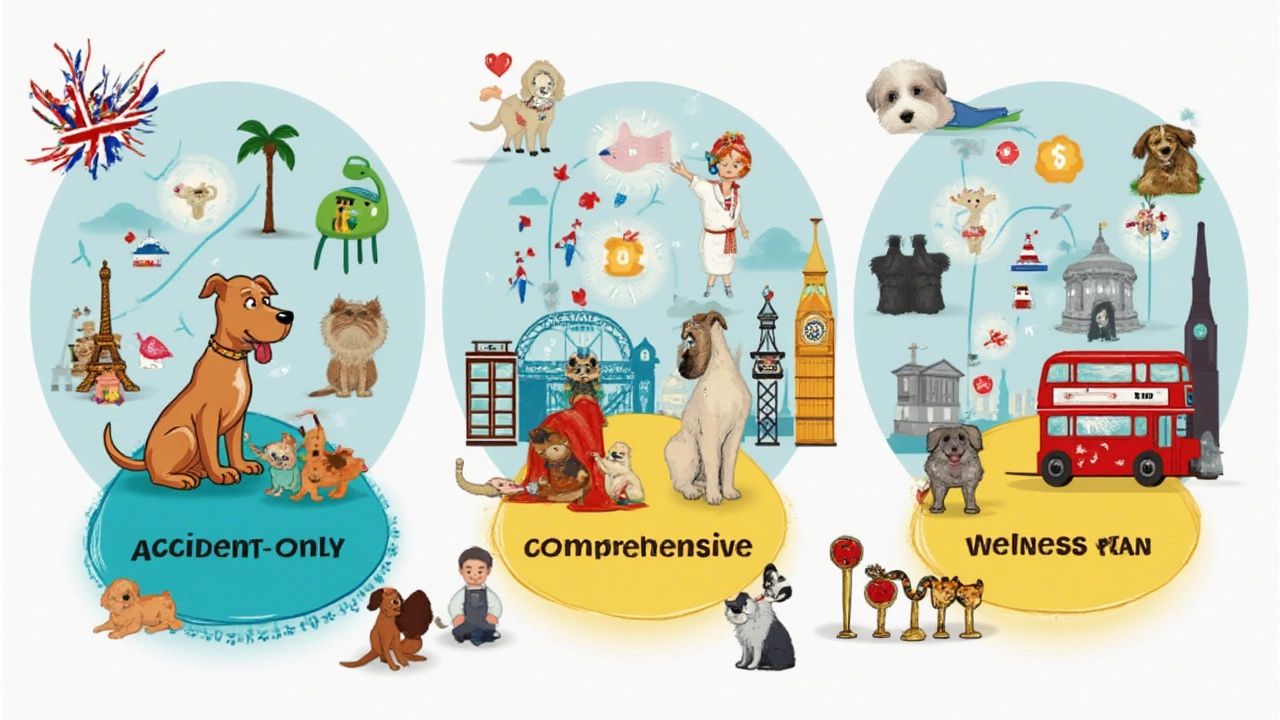

Picking pet insurance isn't as simple as you'd hope. Walk into any clinic and you’ll see dog and cat parents flipping through booklets, trying to decode the jargon. There’s a reason—it’s easy to get lost when you’re hit with phrases like 'accident-only,' 'comprehensive,' and 'wellness.' The truth? Each type of plan fits different needs and budgets.

Ever had a dog swallow a sock? That’s where accident-only plans step in. Got a senior cat who needs meds for arthritis? You’re looking at comprehensive coverage. Wondering why some folks get reimbursed for nail trims or flea meds? Those are the extras from wellness plans. If you've never heard of these categories before, don’t worry—most pet parents haven’t before their first $400 emergency vet bill.

Knowing your options up front could save you hundreds—or even thousands—down the road. Here’s what really matters when you’re comparing pet insurance types, what’s often included (or not), and tips for picking a plan that actually covers the stuff you’ll use most. No fluff. Just facts, examples, and a few insider tips from pet owners who’ve been there.

- Accident-Only Plans Explained

- Comprehensive Coverage: What’s Included?

- Wellness Plans: The Extras

- Choosing the Right Insurance for Your Pet

Accident-Only Plans Explained

If you want a safety net without spending too much, accident-only pet insurance is the simplest and usually the cheapest option. These plans do exactly what they sound like—they only cover injuries from sudden accidents. Stuff like broken bones, cuts, swallowed toys, or if your dog gets hit by a car. Everyday vet visits, illnesses, or routine care are not included.

Here’s what accident-only plans cover most often:

- Bite wounds or animal attacks

- Ligament tears or sprains

- Car accidents

- Bone fractures

- Swallowed objects or poisoning

One big tip: If you’re looking at these plans mostly for peace of mind when it comes to emergencies, pay close attention to the fine print. Some policies won’t cover dental injuries or accident-related follow-ups. Also, these plans usually don’t cover accidents that happen before the policy starts—waiting periods are common (often 2-5 days for accidents).

Just so you get the full picture, take a look at this quick breakdown compared to other main types:

| Plan Type | Average Monthly Cost (Dog) | Accidents Covered? | Illnesses Covered? | Routine Care? |

|---|---|---|---|---|

| Accident-Only | $10–$20 | Yes | No | No |

| Comprehensive | $30–$45 | Yes | Yes | Sometimes |

| Wellness | $20–$35 | No | No | Yes |

Why do people pick accident-only coverage? Maybe their pet is young, healthy, or they just want to avoid a giant bill if disaster strikes. For many, this is their starter plan. But keep in mind, if your dog develops a sickness (like allergies or cancer), pet insurance won’t help unless you upgrade. So ask yourself: Will you sleep better just knowing accidents are covered? Or do you want help with vet bills for illnesses too?

Comprehensive Coverage: What’s Included?

If you want pet insurance that actually pays when your dog starts limping or your cat gets sick out of nowhere, comprehensive coverage is what people are usually talking about. These plans go way beyond just accidents—they cover illnesses, hereditary issues, chronic conditions, and often even prescription meds.

You get a much wider safety net. That means if your puppy ends up with allergies or your senior cat needs treatment for kidney disease, you’re not left footing the whole bill. This is where pet parents really see the value, especially since costs for cancer treatments, diabetes, or surgery run into the thousands fast.

Let’s get clear on what you usually get, and what you often don’t:

- Accident coverage (obviously, things like broken bones or swallowed socks are included)

- Illness coverage: infections, vomiting, diarrhea, ear issues, skin conditions

- Hereditary and congenital condition coverage: Think hip dysplasia, heart disease, or intervertebral disk disease. Some companies have waiting periods on these though!

- Treatment for chronic illnesses: stuff like diabetes, arthritis, allergies

- Prescription medications

- Diagnostic tests: blood work, x-rays, ultrasounds, MRIs

- Surgery (if medically needed)

- Hospitalization

Pet insurance companies love to point out how much you save if your pet gets cancer. Here’s a peek at average vet treatment costs from real claims:

| Treatment Type | Average Cost (USD) |

|---|---|

| Diabetes Management | $2,500/year |

| Cancer Treatment | $4,000 to $10,000+ |

| Knee Surgery (cruciate ligament) | $3,500 |

| Ear Infection (Chronic) | $300/visit |

| Daily Allergy Meds | $600/year |

But here’s the catch: most comprehensive plans don’t include stuff like dental cleanings, regular checkups, or flea preventatives. They also don’t cover pre-existing conditions (any problem your pet had before you got insurance), and some plans may put caps on payouts for certain categories.

Want to make sure you’re not missing something? Always check the policy’s exclusions. Some plans cover genetic conditions, but only if your pet is enrolled before showing symptoms. And don’t forget—to get full value, you have to stick with it year after year. If you drop the plan, you might lose coverage for ongoing issues.

If your budget allows, comprehensive is the safest bet to handle those ‘oh no’ moments. Emergency surgery, that unexpected diabetes diagnosis, even ongoing meds—it’s all there, as long as you read the fine print.

Wellness Plans: The Extras

Wellness plans fill a gap that accident-only and comprehensive pet insurance often leave wide open. While most basic insurance covers unexpected stuff, wellness add-ons handle the routine expenses that sneak up on you every year. Think of these as the preventive care programs for your pet—stuff that keeps your buddy healthy before big problems even start.

So, what exactly do you get with a wellness plan? Here’s a quick breakdown of common benefits:

- Annual checkups and physical exams

- Vaccines (rabies, distemper, parvo—for dogs; FVRCP, FeLV for cats)

- Routine bloodwork

- Flea, tick, and heartworm prevention meds

- Spay/neuter surgeries (with some plans)

- Dental cleanings (not always included in basic insurance)

- Fecal tests and urinalysis

- Microchipping

- Nail trims

Some wellness plans go even further—covering prescription diets, behavior training, or alternative therapies like acupuncture. Each company tweaks its offerings a bit, so always double-check those details.

Here’s a look at what the average wellness plan reimburses, based on 2024 insurance data:

| Service | Typical Annual Allowance (USD) |

|---|---|

| Routine Exams | $50-$100 |

| Vaccinations | $40-$80 |

| Lab Tests | $40-$70 |

| Flea/Tick Prevention | $50-$100 |

| Dental Cleaning | $100-$150 |

Now, should you buy wellness coverage? Here’s a tip: add up what you usually pay for annual care. If it’s close to what the plan costs, you’ll at least break even. If your vet pushes for a lot of extras or your pet's care is higher than average, you might save more. Some pet parents just like the peace of mind—no surprises at the front desk when it's time to pay for shots or a cleaning.

Just know: pet insurance companies usually require you to pick wellness as a rider (add-on), not as a standalone plan. And there are caps, so you might not get full reimbursement on every receipt. Still, thousands of dog and cat owners find wellness coverage helps budget for annual pet care, especially for puppies, kittens, or seniors who need a bit more TLC.

Choosing the Right Insurance for Your Pet

This is where things get real. You want the best for your dog or cat, but nobody wants to overpay for coverage they’ll never use. Think of pet insurance like picking a phone plan: the cheapest might work for someone who rarely calls, but not for a teenager texting non-stop. Here’s how to cut through the noise and actually match coverage to your pet’s lifestyle—and your wallet.

First, consider your pet’s age and breed. Purebred dogs like French Bulldogs rack up vet bills faster than mixed breeds, mainly because of inherited health risks. Kittens and puppies might not need much at first, but costs spike around accidents or one-off disasters (think: eating socks or chewing electric cords).

Here’s what matters when you’re deciding:

- Vet visit costs in your area: Average emergency visit in the US? Around $800–$1,500. In big cities, it’s often higher.

- Your risk comfort: Are you a worrywart who wants peace of mind for every little thing? Or can you handle covering the basics and skip extras?

- Budget: Some plans start at $10/month (accident-only), but most full-coverage options will run $30–$60 monthly per pet.

- Pre-existing conditions: Most insurers don’t cover issues your pet had before your policy starts. Cats with kidney disease or dogs with old injuries usually won’t get those covered.

- Extras: If you want coverage for shots, dental cleanings, or flea meds, you’ll want to add a wellness plan. These are sometimes only available as a "rider" tacked onto bigger plans.

Compare what’s covered before hitting “buy.” Here’s a breakdown of what typical plans include:

| Plan Type | Accidents | Illnesses | Routine Care | Monthly Cost Range |

|---|---|---|---|---|

| Accident-Only | Yes | No | No | $10–$20 |

| Comprehensive | Yes | Yes | Sometimes* | $30–$60 |

| Wellness | No | No | Yes | $10–$25 (Add-on) |

*Routine care may be offered as an extra or rider, not always rolled in.

One smart tip: If your pet is still young and healthy, you’ll pay the lowest rate. Every year you wait, rates go up, and some companies limit new policies for older pets. Also, always read the fine print about deductibles and payout limits. Some companies offer 'per-incident' caps, while others cover up to an annual max—there’s a big difference if your dog faces several emergencies in a year.

Bottom line: There’s no 'one size fits all' with pet insurance. Pick what fits your pet’s risk, your comfort zone, and your budget. Try not to overthink—simple coverage is worlds better than crossing your fingers and hoping nothing goes wrong.